Important Documents, Forms and Qualifications Welcome to the Indian Health Service. This is the second of five videos created to assist you in applying for an Indian health profession position through JOBS.gov. This video will help you identify and prepare all the forms required to apply for an Indian health position. There are several documents and forms that IHS requires from applicants. If applying online these would include: JOBS Cover Sheet. Resume Transcripts Licenses Childcare Addendum Form If submitting your application via fax instead of online, please include: OPM1203FX Form Occupational Questionnaire There are other eligibility and career path preference forms that may be requested. VO will name form and required use and where it can be found: BIA Form 4432 (If you do not have this form already, please request from your Tribal enrollment office prior to applying as it may take several weeks to receive. Boxes A or D must be completed and signed by the appropriate official in order to qualify for Indian Preference in hiring. DD-214 CAP/ICTAPSF-50 for current or former federal employee OF-306 Declaration for Federal Employment SF-15 Application for 10-Point Veteran Preference Many of the preferences and qualifications can be confusing. VO will explain what each acronym signifies and where they are listed in a job posting. DE Delegating Examining Procedures DHA Direct Hire Authority ESP Excepted Service Examining Plan Indian Preference MP Merit Promotion Schedule A Hiring Authority Time-in-Grade Veterans Preference In this video you learned what documents, forms and qualifications are necessary to apply for ankhs job. If you do not have an account with JOBS, please view Video #3 which, describes how to create an account and prepare your documents for submission. You may skip ahead to Video #4 quot;How to Apply" for a civil service or USPS Commissioned Corps position or Video #5 Monitoring your Application if you already have an account with JOBS.gov. Contact us with...

Award-winning PDF software

How to prepare Form Of-306

About Form Of-306

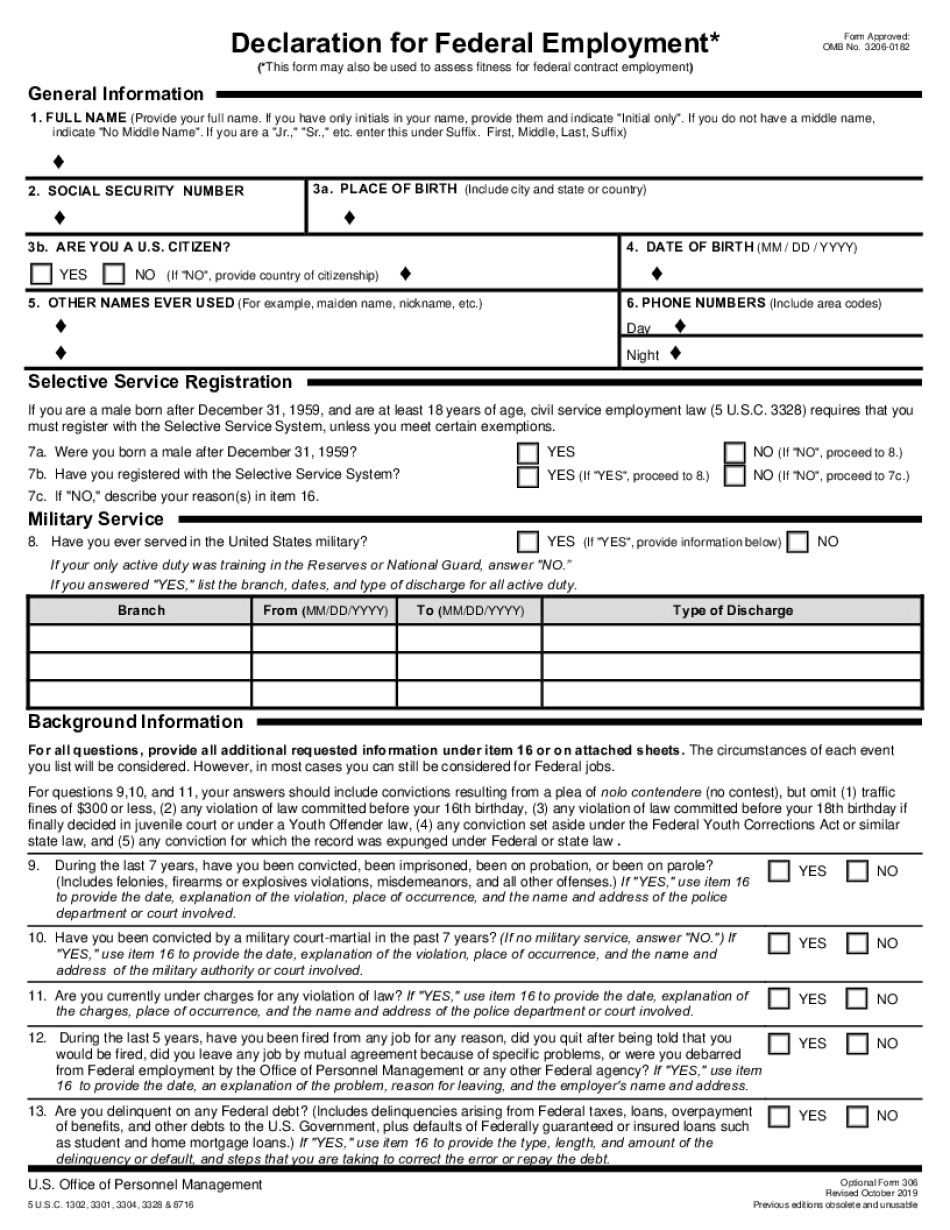

Form OF-306 is a declaration form that states personal information about individuals who are interested in applying for a job position, including government employees. The form collects information such as full name, address, date of birth, social security number, and other personal identification details. This form is required for all applicants who are seeking federal employment with any agency of the United States Government, including the Department of Defense, Department of Homeland Security, Department of Justice, Department of Agriculture, and other federal agencies. The Form OF-306 is used to conduct a background check on the applicant and ensure that they meet the necessary standards for trustworthiness, reliability, and integrity.

What Is Of 306?

If you want to take a position in a federal office, you may be asked to complete the 306 Form. This document is required by the Office of Personnel Management, which manages the hiring process. This document is also known as a Declaration For Federal Employment. It is necessary to determine the applicant’s eligibility for government employment and enrollment in administration programs. To complete this template, gather all the required information. Include the following:

-

personal information, including full name, social security number, date and place of birth, and prior military service;

-

your background information, including prior felonies, employment, current debts, and more;

-

clearly presented details relating to military service, violations of the law, dismissals from work, current debt, etc.

Write only true and accurate data. In other case, there is a big risk to be fired from the job and to be prosecuted in accordance with U.S. Code, title 18 section 1001. It is obligatory to attach additional documentation to prove your qualifications and rewards. It is also necessary to provide SF-50 Notification of Personnel Action, and/or Veterans' Form DD-214. Send the completed 306 2024 form straight to the address of the federal authorities from whom you are seeking hiring for desired position.

Online systems help you to prepare your document management and strengthen the productivity within your workflow. Carry out the short guide to complete Form Of-306, keep clear of faults and furnish it inside of a timely fashion:

How to accomplish a Form Of-306 on the net:

- On the web site while using the variety, click on Launch Now and move for the editor.

- Use the clues to fill out the pertinent fields.

- Include your own facts and get in touch with facts.

- Make certain that you choose to enter correct details and figures in appropriate fields.

- Carefully examine the content in the kind likewise as grammar and spelling.

- Refer that can help segment for people with any questions or address our Assist staff.

- Put an electronic signature in your Form Of-306 with all the enable of Indication Instrument.

- Once the form is done, press Executed.

- Distribute the ready variety via e mail or fax, print it out or help save on your gadget.

PDF editor allows you to make changes with your Form Of-306 from any internet connected device, customize it in line with your requirements, indicator it electronically and distribute in different options.

What people say about us

The growing need for electronic forms

Video instructions and help with filling out and completing Form Of-306